rpgt exemption malaysia 2019

Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. Company with paid up capital not more than RM25 million.

How The New Rpgt Ruling Is Affecting The Rakyat

Article 41 and Article 1211 of the Federal Constitution of Malaysia 1957.

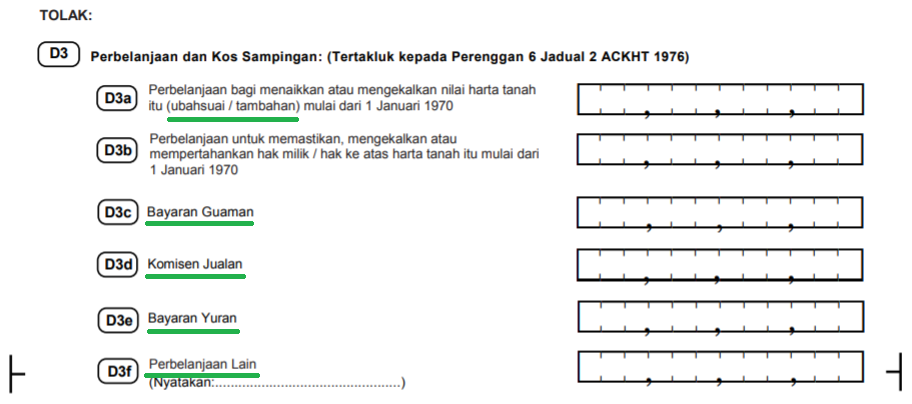

. 5 of the total acquisition price where the disposer is a company incorporated in Malaysia or a trustee of a trust or a body of person registered under any written law in Malaysia. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai. Real Property Gains Tax RPGT Rates.

With effect from 12102019 where a disposal is subject to tax under Part I of Schedule 5 references to 111970 shall be construed as references to 112013. A 202 1998. A 201 1998 2.

There is no withholding tax on dividends paid by Malaysia companies. Real Property Gains Tax RPGT Rates. Ii To claim the DTA rate please attach the Certificate.

Prosedur Pengemukaan Borang Nyata Terpinda Available in Malay Language Only Superceded by GPHDN Bil. Superceded by the Tax Audit Framework 15122019 - Refer Year 2019. 5001 - 20000.

For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil. However the amendment does not apply to the disposal of shares under paragraph 34 of Schedule 2 and shares in a real property company under paragraph 34A of Schedule 2. CLAIMING CAPITAL ALLOWANCE ON THE DEVELOPMENT COST FOR CUSTOMISED COMPUTER SOFTWARE UNDER THE INCOME TAX RULES 2019.

From 1 January 2019. Dividend Income Update 2019. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC. Ada update paling terbaru di bawah Bajet 2022 Menteri Kewangan Tengku Zafrul mengumumkan bahawa kerajaan tidak lagi akan mengenakan Cukai Keuntungan Harta Tanah atau RPGT bagi pelupusan hartanah oleh individu terdiri daripada warganegara Malaysia pemastautin. Effective from the year of assessment 2019 if an estimated assessment is raised under subsection 903 of the ITA on a company limited liability partnership trust body or co-operative society due to failure to submit an Income Tax Return Form ITRF an appeal by way of a Form Q against that assessment must be submitted together with the.

Garis Panduan Bagi Kelulusan Ketua Pengarah Hasil Dalam Negeri Di Bawah Subseksyen 446 Akta Cukai Pendapatan 1967 Bertarikh 5 September 2019 Pindaan subperenggan 61iv 4. Dividend Income Update 2017. Dividend Income Update 2016.

The amount of increase in tax charged for an Amended Return Form furnished within a period of 6 months after the date specified in subsection 771 of ITA 1967 shall be 10 of the amount of such tax payable or additional tax payable as shown in the following formula-. From the period of 112019 until 31122021 disposal in the sixth year after the date of acquisition of the chargeable asset is 5. Real Property Gains Tax CKHT English BM.

The RPGT Act defines a private residence as a building or part of a building owned by an individual or occupied as a place of residence. Order 92 Rule 4 of the Rules of Court 2012. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.

Pada tahun 2014 kadar CKHT telah dinaikkan bagi 5 tahun berturut-turut sejak 2019. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967. Assessment Year 2018-2019 Chargeable Income. On the First 5000.

Under the recent Budget 2022 Finance Minister Tengku Zafrul announced that the government will no longer impose Real Property Gains Tax or RPGT for property disposals by individuals comprising Malaysian citizens and permanent residents starting from the sixth yearThis means that the RPGT rate for property disposals in the 6th year and. Find out how much you will be taxed when you sell your property in Malaysia using our online RPGT calculator aka. RM10000 or 10 of the chargeable gain whichever is greater.

Garis Panduan Bagi Permohonan Untuk Kelulusan Di Bawah Seksyen 446 Akta Cukai Pendapatan 1967 Bertarikh 15 Mei 2019 5. Dividend Income Update 2018. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

What are the RPGT rates of 2019. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber. 28 December 2020.

However a real property gains tax RPGT has been introduced in 2010. 3 September 2019 EiF. Then theres another revision to the RPGT under Budget 2020 as well as the Exemption Order.

Purchase of basic supporting equipment for disabled self spouse child or parent. Government of Malaysia V MNMN. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

RPGT rates 2019 Citizens Non citizens Company. Permohonan Surat Penyelesaian Cukai bagi Syarikat Perkongsian Liabiliti Terhad dan Entiti Labuan Available in Malay Language Only Superceded by GPHDN Bil. Malaysian citizens and permanent residents are entitled to elect a one-time RPGT exemption on the disposal of a private residence.

Another huge advantage of Malaysian REITs is the exemption of tax on the moving of properties. Calculations RM Rate TaxRM 0 - 5000. Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007.

In 2014 the RPGT was increased for the fifth straight year since 2009. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. First it was suspended temporarily from April 2007 to December 2009 and reintroduced in 2010.

In 2019 the RPGT rates have been revised. RPGT Exemptions 2022. Superceded by the Public Ruling No.

When REITs in Malaysia dispose of their assets they do not have to pay real properties gain tax RPGT as well. Effective from 1 January 2020 individuals who are not Malaysian citizens are subject to RPGT at a rate of 30 for a holding period up to five years and 10 for a holding period exceeding five years. Now here is some history about the RPGT.

EXEMPTION NO9 ORDER 2017 PUA 3232017 07122017. There is no capital gains tax for equities in Malaysia. Tax Audit Framework available in Malay version only.

Real Property Gains Tax RPGT Rates. Once-in-a-lifetime exemption on any chargeable gain from the disposal of a private residence.

Real Property Gains Tax Rpgt And Stamp Duty Exemption Cheng Co Group

All About Rpgt Real Property Gain Tax 2019 My Awesome Property

Understanding Rpgt Legally Malaysians

All You Need To Know About Real Property Gains Tax Rpgt

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gains Tax Rpgt Guide For The Year 2020 2021 In Malaysia

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

28 Gunalan Associates Ideas Taxact Save Money Travel World Street Food

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Solved Siblings Aishwarya Dhanya And Ganesh Own Properties Around Course Hero

Newsletter 28 2019 Income Tax Exemption No 3 Page 001 Jpg

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

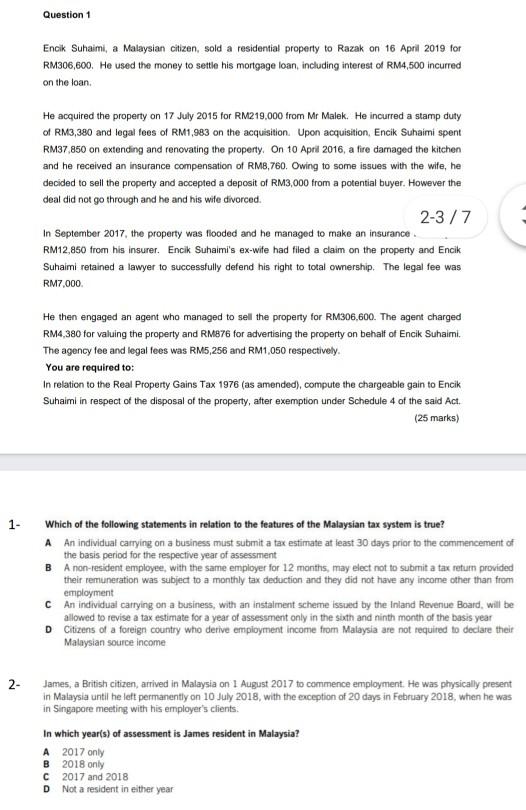

Solved Question 1 Encik Suhaimi A Malaysian Citizen Sold A Chegg Com

Real Property Gains Tax Rpgt Notes Law512 Conveyancing

Taxplanning Rpgt Exemption The Edge Markets

Real Property Gains Tax Rpgt Guide For The Year 2020 2021 In Malaysia

Real Property Gains Tax Rpgt In Malaysia 2022

Exemption Of Rpgt Service Tax From Jan 1 2019 Iproperty Com My

0 Response to "rpgt exemption malaysia 2019"

Post a Comment